GEN is “Emerging”

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,750,000 GEN shares and 1,250,000 options at the time of publishing this article. The Company has been engaged by GEN to share our commentary on the progress of our Investment in GEN over time.

After being in suspension for 8 long months...

And doing a recapitalisation raise at 10c.

Genmin (ASX:GEN) came back on the boards last month.

GEN traded below the recap raise price for a few weeks while some tired, tapped out, long term holders took the opportunity to exit when it finally re-listed.

It seems they are now gone.

Over the last few days the GEN share price has started running up, hitting 17c yesterday.

We are hoping this is the start of our “recap raise” theory playing out for GEN, where our view was that the market was undervaluing GEN’s advanced stage project due to some temporary bad luck, debt (now cleared) and previous negative macro events.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

GEN is the first addition to our Emerge Portfolio - where we look for companies with genuine, valuable assets that have recently gone through a recapitalisation round.

A recap round can happen when a company has a real, valuable asset - but a tired, disillusioned and financially tapped out shareholder base, which had been pushing the share price down by selling due to solvable medium term issues.

Foster Stockbroking analyst Mark Fichera recently upgraded the GEN price target to 61c from 49c - you can read the full GEN analyst report here. Fosters was the lead manager on the recapitalisation raise.

(Source)

Whilst that price target looks pretty good, it's worth noting that analyst price targets are based on a number of assumptions that may not eventuate. Never invest on a price target alone, do your own due diligence before making an investment.

We hope that post a recapitalisation round, the market will eventually start valuing the assets and the share price will move up.

We are starting to see this with GEN now.

GEN owns 100% of a construction-ready green iron ore project in Gabon.

Green iron ore - to go into green steel.

Green Steel is one of the biggest macro thematics we expect to shine over the next 5-10 years.

Steel production makes up 6-9% of the world's carbon emissions and steel is used in just about everything we make.

Our way of gaining exposure to this thematic is through GEN.

GEN’s project already has an ore reserve, mining permit, environmental permitting, a feasibility study AND 4x different offtake MOU’s with some of China’s biggest steel manufacturers.

AND GEN also has a clean energy supply via a hydro-electricity deal - to cleanly process its ore to green grade.

The next major catalysts for the company are financing deals to get its project into construction.

GEN needs to find at least US$200M to fund its CAPEX and bring its 5 Mtpa starter mine online.

The 5 Mtpa starter mine has a Net Present Value of US$391M.

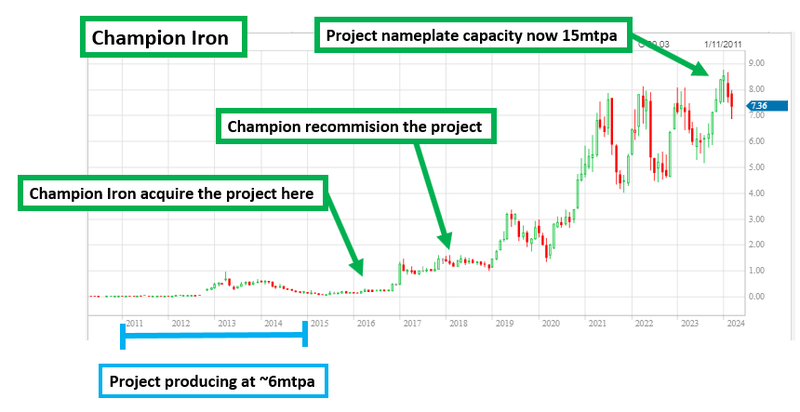

AND GEN’s plan is to eventually expand production capacity by 4x to 20mtpa...similar to what ASX iron ore success story Champion Iron did...

Between 2011 and 2014, Champion Iron’s project was producing at ~6mtpa.

Now it produces at ~15mtpa and Champion’s share price is >3,800% higher than in 2011:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We are Invested in GEN to see it execute its development strategy and hopefully achieve a similar re-rate in share price to Champion over the next 3-5+ years.

As mentioned earlier - like any bulk commodity developer, the biggest current hurdle for GEN is financing...

In its recent report, Fosters analysts assumed US$270M in funding is required (CAPEX, working capital, corporate), via a 67:33 debt: equity mix.

Financing is where we want to see GEN leverage its 4x offtake MOUs to try and pull in some “non-conventional” financing for the project.

Again, it's not anything we haven't seen before...

One of GEN’s offtake MOU’s is with Hunan Iron & Steel - the same Chinese steel maker that backed ASX iron ore success story Fortescue Metals Group back in 2009.

At the time, Hunan invested >$500M into FMG, becoming FMG’s second-largest shareholder.

(Source)

At the time, back in 2009, Fortsecue was trading at $2.48.

Today Fortescue is one of the great Australian success stories, with a share price of over $26, and a $82BN market cap.

We think Hunan would have been pretty pleased with how its bold bet backing an Australian iron ore miner turned out:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

For now, Hunan’s involvement in GEN is just an MoU for an offtake.

A major catalyst we would like to see is for someone like Hunan to come in and partially underwrite the development of GEN’s project.

That is the blue sky financing scenario for GEN.

How GEN fits into our Emerge Portfolio

We recently launched our new “Emerge” Portfolio.

One of the key triggers for the new Portfolio was that we were seeing a lot of companies with real assets going through recapitalisation rounds - GEN being the perfect example.

We had GEN on our watchlist all the way back in 2022 and had been following the story relatively closely.

We then saw the company go into suspension in mid 2023 only to stay suspended for ~8 months.

During that period we saw the company get a mining permit and the political situation in Gabon stabilise.

Despite all of the progress at a fundamental level - we noticed GEN’s re-listing raise was exactly what we looked for in a recapitalisation round:

- The company had real, later stage assets - GEN’s iron ore project is shovel ready and now permitted...

- Company had temporarily fallen on hard times, due to bad luck that was not within its control - GEN was suspended for over 6 months as Gabon went through a change in political leadership...

- Sentiment swinging towards the macro theme in which the company operates - the green steel narrative keeps getting stronger as time goes on...

- Fresh cap structure and clean balance sheet to execute business plan - we noticed GEN was clearing out its debts and coming back onto the ASX with a positive net cash position...

GEN raised ~$23.2M at 10c (cash and loan conversions) as part of the recap and ended the March quarter with US$6.1M (A$9.2M in cash).

We also noticed GEN’s major shareholder Tembo Capital’s principal Managing Director John Hodder take $1.65M in the 10c round personally...

Tembo Capital own circa 50% of GEN shares.

When it comes to successful recapitalisations on the ASX, Tembo have been there and done it all before.

Tembo was behind the restructuring of Paladin Energy, whose market cap was ~$80M while the company was in administration back in 2017.

Now Paladin still trades on the ASX and has a market cap of ~$4BN - all in under 6 years.

Tembo looks like it knows a good opportunity when it sees one. They are specialists in investing in development-stage companies and, importantly, holding them through to a successful exit.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

How GEN’s been trading since our Investment

Our Initial Entry Price in GEN is 10c.

After GEN came out of suspension, it actually traded between 8.5c and 10c for a few weeks (below our Initial Entry Price of 10c) as stale shareholders exited.

As we noted above, this week we noticed GEN’s share price started to run - its share price hit a peak of 17c yesterday.

This type of share price move is what we hope to eventually see after a company goes through a recapitalisation.

After a recapitalisation - and especially after a long suspension - we always tend to see more selling on market in the first few weeks after the company is trading again.

(some people stuck in a long suspension just want their money out asap).

The stale, long term shareholders take control for a few weeks (sometimes months) and continue selling on market.

After the stale holders have exited, selling dries up and buyers start to take control...

Usually, that is a good signal the drying from stale holders is done and new investors are coming into the story to hopefully back the company through to its mid-term objectives.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We are one of those new Investors and ultimately, we want to see GEN get its project financed and into production.

We are hoping that once in production, GEN’s share price is re-rated based on the company being a producer and no longer a developer.

All of that forms the basis for our GEN “Big Bet” which is as follows:

Our GEN Big Bet:

“GEN re-rates 1,000% by scaling up its production over time from its iron ore project in Gabon”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GEN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

What’s next for GEN?

In the near term we are looking for GEN to make progress across offtakes and financing.

With 4 MoUs for offtake already secured, we think GEN will be looking to make these offtakes binding and in doing so, firm up the financing picture.

We expect there would be some competitive tension around GEN’s premium product - and things could move quickly once any of these 4 MoUs are converted into a binding agreement.

These are the two objectives we’ve set for GEN across offtakes and financing - both are closely related.

Objective #2: Convert Offtake MoUs to Binding Contracts

Milestones

🔄 Binding offtake #1

🔄 Binding offtake #2

Objective #3: Secure US$200M in CAPEX financing

Milestones

🔲 Confirm funding strategy

🔲 Secure debt financing

🔲 Secure equity financing

🔲 Secure binding offtake agreements

🔲 Secure prepayments for offtake or other strategic capital partners.

What are the risks?

We’re particularly focussed on these two risks at the moment:

Financing and delay risk

The development of Baniaka will require ~US$270M in debt and equity funding (a number that estimates on CAPEX working capital and corporate expenses), to be raised in financial markets.

Financial markets are inherently uncertain and readily influenced by global macro-economic events at the time.

GEN may experience delays in procuring the funding and consequently development of Baniaka through exposure to the sentiment in financial markets, which may adversely affect GEN’s value and share price.

Jurisdiction risk/political risk

In August 2023, a military coup affecting regime change occurred in Gabon.

A transitional, appointed rather than elected, government has been put in place with elections scheduled to be conducted in August 2025.

While the population of Gabon has generally supported the coup - there are uncertainties about the future political climate of Gabon.

For example, delays in holding elections and returning to an elected civilian government may lead to economic, political, and social risks materialising that adversely impact GEN’s ability to develop Baniaka and subsequently produce, export and sell iron ore products.

To see all of the key risks to our GEN Investment Thesis, check out our GEN Investment Memo.

Our GEN Investment Memo

In our GEN Investment Memo, you can find:

- GEN’s macro thematic

- Why we Invested in GEN

- Our GEN “Big Bet” - what we think the upside Investment case for GEN is

- The key objectives we want to see GEN achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.